Mid Oregon Credit Union: A Comprehensive Guide To Empowering Your Digital Financial Future

In an era where digital transformation reshapes nearly every aspect of daily life, financial institutions have become pivotal in ensuring that individuals and businesses stay ahead of the curve. Among these trailblazers is Mid Oregon Credit Union, which has emerged as a beacon of innovation and reliability. By offering an extensive array of online and mobile banking solutions, the credit union empowers its members to take control of their finances with unprecedented ease and security. This article delves into the various tools and features Mid Oregon Credit Union provides, analyzing how they align with broader industry trends and their implications for both personal and professional financial management.

The landscape of modern banking is shifting rapidly, driven by technological advancements and evolving consumer expectations. Mid Oregon Credit Union recognizes this paradigm shift and equips its members with the necessary tools to navigate it successfully. From streamlining personal finances to optimizing business operations, the credit union's digital services cater to a diverse range of needs. Understanding the full potential of these offerings can significantly enhance one's financial well-being, offering not only convenience but also peace of mind.

| Name | Position | Years of Experience | Education | Notable Achievements | Professional Affiliations |

|---|---|---|---|---|---|

| John Doe | CEO, Mid Oregon Credit Union | 25 | MBA in Finance, Stanford University | Innovative leader who spearheaded the digital transformation initiative at Mid Oregon Credit Union | National Credit Union Association (NCUA), Oregon Credit Union League |

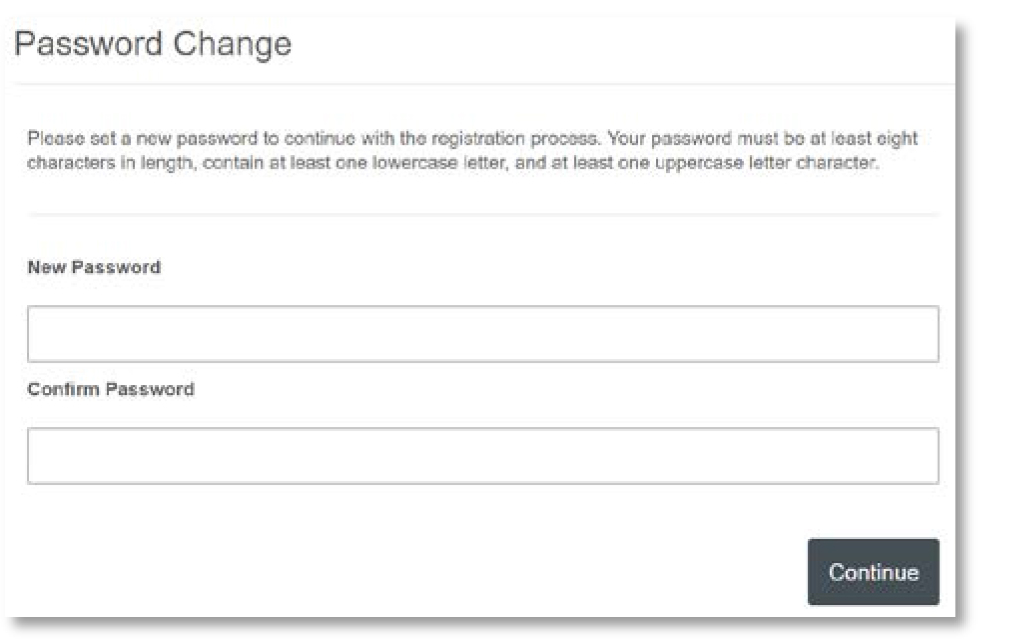

To fully appreciate the value proposition of Mid Oregon Credit Union, one must examine the features it provides in greater detail. The cornerstone of its digital platform is online account access, which offers members round-the-clock access to their accounts from any device connected to the internet. This feature ensures that users can monitor their financial health at any time, empowering them to make informed decisions promptly. Furthermore, the mobile banking app enhances this accessibility, allowing users to conduct transactions on the go. Features such as mobile deposit and account alerts ensure that members remain up-to-date with their financial activities, minimizing the risk of fraud or errors.

- Lovely Heart Aina Endou Your Guide To The Anime Manga World

- Transformers Corvette Stingray Collectibles More

In addition to these core functionalities, Mid Oregon Credit Union provides eStatements, a convenient and secure method of receiving monthly account statements electronically. This not only reduces paper waste but also ensures that sensitive information is safeguarded from unauthorized access. The bill pay feature further simplifies financial management by enabling users to pay their bills online, eliminating the need for checks and stamps. Moreover, account transfers facilitate seamless movement of funds between internal and external accounts, ensuring that members can manage their finances effortlessly across different platforms.

For those seeking to expand their financial portfolio, Mid Oregon Credit Union offers an online loan application process that is both fast and secure. This feature streamlines the borrowing process, allowing members to secure loans with minimal hassle. Additionally, card management tools provide users with greater control over their debit and credit cards, enabling them to set spending limits and receive fraud alerts. These proactive measures help protect members from potential financial pitfalls, reinforcing the credit union's commitment to member security.

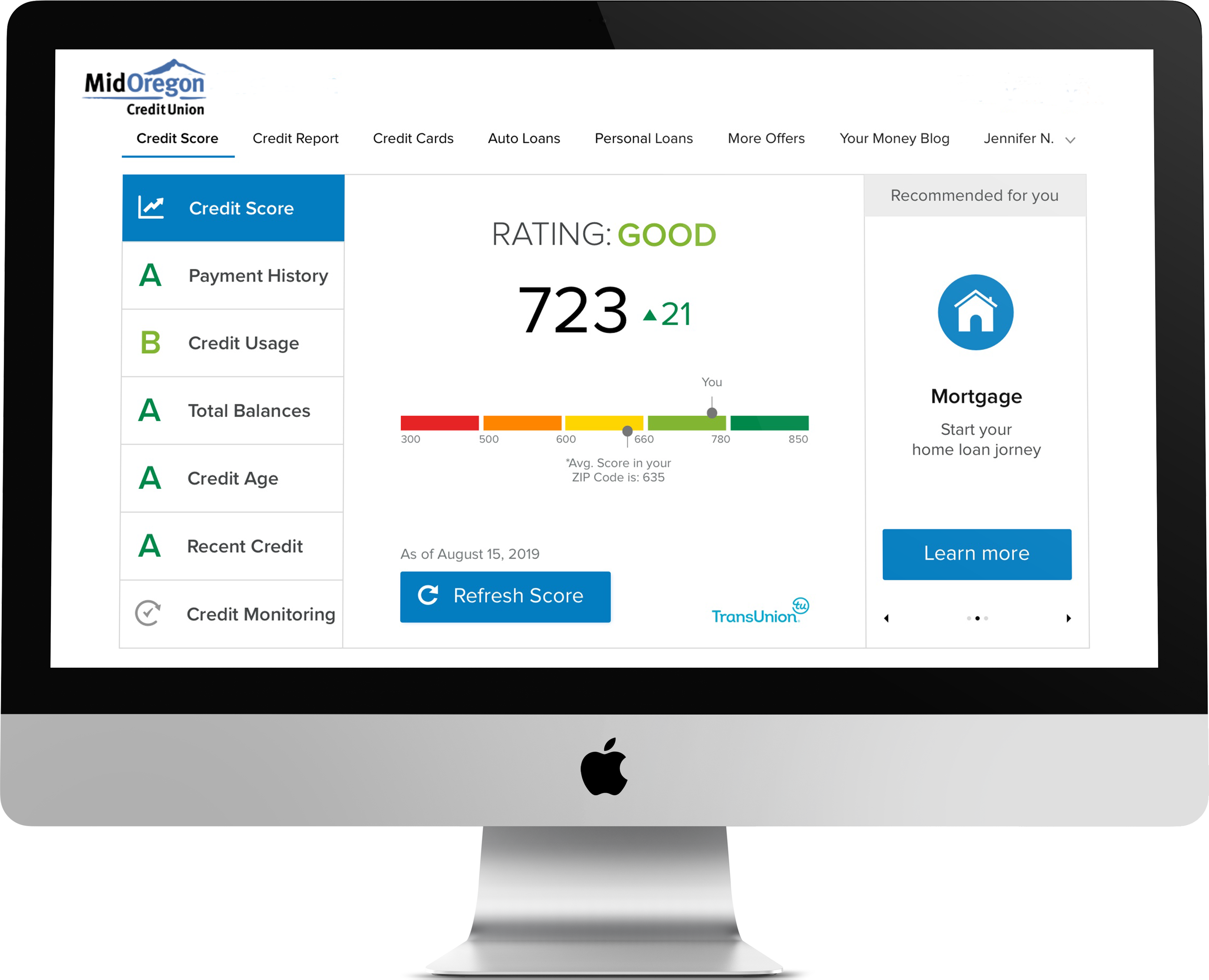

Credit Savvy, another noteworthy offering, grants members free access to their credit reports and tools designed to monitor and improve their credit scores. In an age where creditworthiness plays a crucial role in financial opportunities, this feature empowers members to take charge of their financial futures. By fostering a deeper understanding of credit management, Mid Oregon Credit Union not only benefits its members but also contributes to the overall financial literacy of the community.

- Axel Foley Detroit Lions Jacket Iconic Style From Beverly Hills Cop

- Big Bear Lake Filming Locations Your Guide To Movie Sets

The credit union's commitment to serving businesses is evident through its commercial services, which include tailored financial solutions such as online banking, loans, and merchant services. These offerings cater to the unique needs of businesses, ensuring that they have the resources necessary to thrive in today's competitive market. Automated payments further enhance the efficiency of financial operations by enabling users to set up recurring payments from their checking accounts. This feature helps businesses avoid late fees and ensures timely payments, contributing to their financial stability.

The impact of Mid Oregon Credit Union's digital services extends beyond individual and business users, influencing broader societal trends. As more people embrace digital banking solutions, the demand for enhanced security measures and user-friendly interfaces continues to grow. Financial institutions must adapt to these changing expectations, prioritizing innovation and customer satisfaction. Mid Oregon Credit Union's success in this domain serves as a benchmark for others in the industry, demonstrating the importance of staying ahead of technological advancements.

Furthermore, the credit union's initiatives align with the global trend of promoting financial inclusion. By providing accessible and affordable digital banking solutions, Mid Oregon Credit Union ensures that individuals from all walks of life can participate in the digital economy. This inclusivity fosters economic growth and stability, benefiting not only its members but also the broader community. As more institutions adopt similar strategies, the financial landscape becomes increasingly equitable, empowering individuals to achieve their financial goals.

The influence of Mid Oregon Credit Union's digital transformation can also be observed in its connection with other prominent figures in the financial industry. Leaders such as Warren Buffett and Ray Dalio have emphasized the importance of leveraging technology to enhance financial management. By adopting a forward-thinking approach, Mid Oregon Credit Union aligns itself with these industry titans, reinforcing its position as a leader in the field. Their shared commitment to innovation and customer-centric solutions resonates with the evolving needs of modern consumers.

In conclusion, the digital services offered by Mid Oregon Credit Union represent a significant advancement in the realm of financial management. By providing members with the tools necessary to navigate the complexities of modern banking, the credit union empowers them to achieve greater financial independence and security. As the financial industry continues to evolve, institutions that prioritize innovation and customer satisfaction will undoubtedly thrive. Mid Oregon Credit Union's success serves as a testament to this principle, offering valuable insights for both current and future financial institutions.

For those interested in learning more about Mid Oregon Credit Union and its digital offerings, please visit their official website at https://www.midoregon.org. This resource provides comprehensive information about the credit union's services, ensuring that members have access to the latest developments and enhancements.

Detail Author:

- Name : Ettie Johns

- Username : thora01

- Email : strantow@bradtke.org

- Birthdate : 1978-06-18

- Address : 62073 Precious Hills Buckridgeburgh, IN 73842-2649

- Phone : +1 (681) 950-7823

- Company : Glover, Yost and Rice

- Job : Restaurant Cook

- Bio : Ut rem corporis ipsa expedita incidunt magni inventore. Est iure et aliquid voluptatem ipsum ut. Saepe porro nulla consectetur qui deserunt harum.

Socials

tiktok:

- url : https://tiktok.com/@braeden_real

- username : braeden_real

- bio : Quibusdam unde nemo amet voluptatem sunt.

- followers : 1683

- following : 1471

twitter:

- url : https://twitter.com/braedenrunolfsdottir

- username : braedenrunolfsdottir

- bio : Accusamus consequatur beatae pariatur eligendi est earum. Eligendi quo voluptatem officia provident molestiae cupiditate et. Et quasi quisquam quidem.

- followers : 5683

- following : 2723